Vendor risk management encompasses a wide range of third-party risk that includes operational, financial, reputational, regulatory, strategic, geopolitical and cybersecurity risks. If these third parties fail to uphold their end of the deal when it comes to security, or if they’re the victim of a cyberattack, it could impact your organization directly. Many of these risks also impact a company from multiple angles. Remember the Okta third-party breach? The breach not only affected Okta’s security but also its reputation and posed financial risks as its stock fell in percentage points shortly after the incident.

What is Vendor Risk Management (VRM) in 2024?

Vendor risk management is a strategy designed to limit the number of threats, vulnerabilities, and weaknesses your organization faces from your business relationships with the goal of mitigating risk of cybersecurity attacks that disrupt business operations.

For customer-facing organizations in healthcare for example, disruption of their critical operations can lead to life-threatening situations. The ransomware attack on hospital and healthcare network Universal Healthcare Systems during the pandemic resulted in patients being redirected to other emergency rooms and delaying tests results.

But first let’s take a step back for a moment.

What is a Vendor?

A vendor is typically a third-party organization that sells a product, service, or piece of equipment that your business needs to operate. An effective third-party risk management program needs to focus on multiple layers of protection.

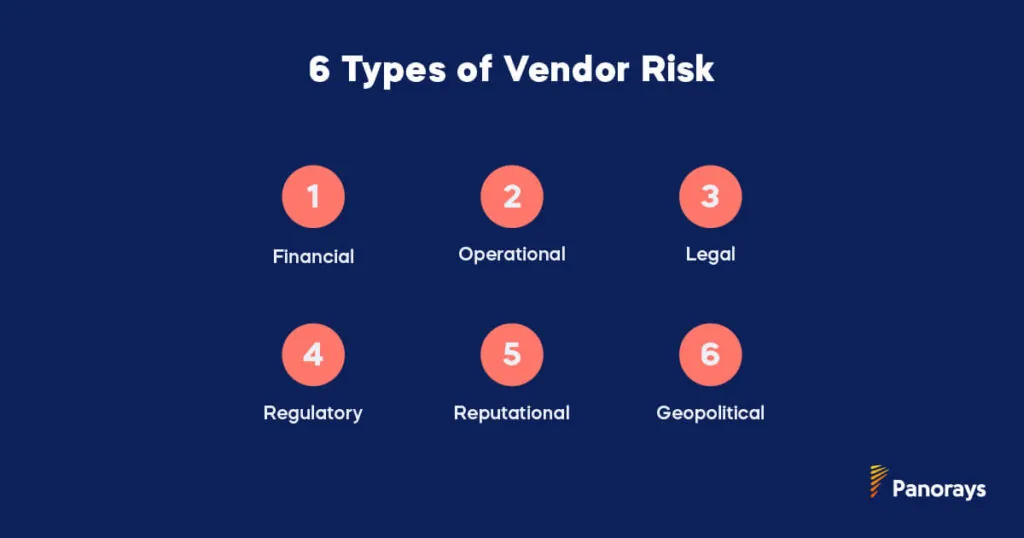

Types of Vendor Risk

Each third-party vendor, upon being connected to your organization, is going to carry some level of cybersecurity risk. Risks could be financial, operational, legal, regulatory, reputational and even geopolitical.

If a vendor fails to uphold their end of the deal in matters of security (e.g. they don’t implement proper security controls or data encryption), or if they’re the victim of a cyberattack, it could impact your organization directly. An effective risk assessment, as part of a greater vendor risk management plan, strives to identify and fix these potential failure points long before they become a problem.

Why is Vendor Risk Management Important?

Even if your own internal security measures are strong, integrating third-party vendors who don’t follow best practices into your IT infrastructure can pose a big risk to your organization. This is especially true when those vendors handle confidential, sensitive, proprietary, or classified information. Vendor risk management provides a documented strategy that helps your organization streamline the VRM process.

An effective VRM program should:

- Mitigate third-party risk. A process for accurately assessing the risk of any new vendor, reducing your organization’s risk exposure over time.

- Minimize operational disruptions. A clear process for vendor risk management ensures that each component of your organization knows its role in evaluating third-party risk so that no processes are overlooked or skipped. This ongoing, proactive approach to vendor risk helps your organization stay ahead of any breach, attack or security incident, ensuring business continuity.

- Provide better ability to meet regulatory compliance. A streamlined process for onboarding vendors that includes due diligence makes it easier to evaluate vendor compliance and decide whether or not to enter into a new business relationship or employee measures to remediate the risk.

- Ensure greater transparency. Since information on vendor risk is open and available across the organization, executive leadership can work together with your security and business teams to evaluate the potential impact of risk across the entire vendor ecosystem.

- Increase operational efficiency. Automating the vendor risk management process means faster risk assessments and optimized workflows, allowing for greater collaboration across teams. A good vendor risk management program also ensures that vendors are paid on time and for their products or services.

- Allow for more effective use of time and resources. It’s easier to address potential risks than to deal with them after they occur. A strategic and detailed approach to the vendor risk assessment process also frees up your management and executive teams to focus on business growth, rather than having to stop in the middle of their current projects to focus on onboarding, compliance, or managing risks.

The Vendor Risk Management Framework

A vendor risk management framework is the system an organization uses to create its defense program for vendor risk. It is the first step a CISO should take before deciding to invest in resource-draining vendor risk management software and solutions. The vendor risk management framework you choose should be based on your risk appetite, industry, compliance requirements and reliance on third parties, as well as the resources you are able to dedicate to vendor risk management. Although first developed for critical infrastructures, the NIST Cybersecurity Framework is the most widely adopted risk management framework by leading global organizations of all sizes and industries today.

The 3 Stages of the Vendor Risk Management Lifecycle

Since the level of security risk also varies widely depending on additional factors such as the type of organization, industry, third-party relationship, technologies, and relevant regulations, organizations need to continue to employ third-party vendor risk management throughout the lifecycle of the business relationship.

These stages can be divided into three separate periods:

- Onboarding. Due diligence is conducted at the beginning of the vendor relationship to evaluate whether or not the business should enter into a relationship with the third party in question.

- Ongoing monitoring. Security risks are regularly evaluated during the vendor relationship to ensure the third party is applying the appropriate security controls to meet the relevant regulations and standards.

- Offboarding. Vendors who terminate their relationship with your organization must have a process for disengaging, deleting and transferring sensitive data and information formerly shared with your organization so that it cannot pose a future threat.

How to Implement a Vendor Risk Management Program

Implementing a vendor risk management program is essential for managing vendor risk throughout the vendor lifecycle. Vendor risk assessments and cybersecurity questionnaires should be regularly sent to vendors to continually assess the risk they pose to your organization and establish a policy for addressing these risks – before they impact your business.

The general process for developing a vendor risk management program typically includes defining your objectives, setting up a vendor risk management team, and establishing a process for vendor risk management. After this, you’ll need to develop a list of your vendors, identify vendor risks, and evaluate the risks based on predefined criteria.

At this point, you can then categorize the risks according to predetermined criteria and incorporate the security requirements your vendors must take into the contract. The contract should also clearly state who is responsible for risk assessments and the roles of each party in the event that high risk is found during the assessment. Vendor risk management programs must be continual and should be improved over time.

Vendor Risk Management Software

Two trends will continue for the foreseeable future in cybersecurity. The first is that businesses will increase their reliance on third parties that are integrated into their IT infrastructure. The second is that the scope and sophistication of threats will continue to evolve.

With this in mind, organizations are constantly looking to improve their methods for defending against third party threats. They look to vendor risk management software to help them automate and streamline the process of onboarding, managing, mitigating, identifying and monitoring third-party risk at scale.

How Companies Manage Vendor Risk

As your technology, the cybersecurity landscape and reliance and use of third parties changes, vendor risk is dynamic and needs to be monitored continuously. For example, if your payment processing vendor makes a small change to their infrastructure, it may suddenly fail to meet compliance and impact your organization. This is particularly true if you rely on this vendor for capabilities that help you meet compliance, such as data encryption, firewalls, or data breach detection software.

If your organization is going to be successful with your vendor risk management, you’ll need to pay close attention to these areas:

- Specific goals and directives. What are you hoping to achieve with your vendor risk management strategy? There are several areas of potential vulnerability in your vendors and in your business, but which ones are your biggest concerns or biggest priorities? What steps will you follow to review new vendor candidates? How will your strategies evolve over time?

- Context-based relationships. Your vendors should be assessed based on their specific business and technological relationship with your company. For example, a vendor that connects to your business’ IT systems should be treated as more of a risk than a vendor that delivers paper supplies to your business.

- Continuous monitoring. Since new technologies are constantly being introduced, you will need to make sure you’re monitoring your vendors on a constant basis. Even a temporary decline of vigilance can create a blind spot.

- Engagement. It’s best to treat vendor risk management as a kind of partnership between you and your vendors. Accordingly, you should strive for engagement; request your vendors to be open and honest about how they’re operating. Let them know what your standards are (and why they’re your standards), so you can both learn and benefit from the arrangement.

- Legal prioritization. It’s important to fully understand the legal consequences of your actions and the regulatory standards that you must meet in your vendor relationships. For many businesses, regulatory compliance is the top priority for any vendor risk management strategy.

What is Vendor Relationship Management?

Vendor relationship management (VRM) is the process of managing and improving third-party vendor relationships with the goal of achieving the maximum possible benefit for both parties. It’s a collaborative approach that works towards minimizing costs, optimizing vendor performance, negotiating contract terms and fostering better communication between the vendor and the buyer. It also includes establishing and evaluating risk management frameworks and performing regular risk assessments for each vendor.

What is an Enterprise Vendor Risk Management Program?

An enterprise vendor risk management program is a holistic approach to managing risk across your organization. This includes all risks posed to your organization in addition to vendor risk. For example, it considers potential impact from terrorist attacks, natural disasters and economic crises.

It is broader than both vendor risk management and third-party risk management yet encompasses both and can help optimize supply chain risk management. Since it is connected to business risk and an enterprise-wide approach however, it demands strategy and control from top-level leadership.

Why You Need to Manage Your Vendor Risks

A security risk assessment (SRA) is designed to help you evaluate risk and maintain compliance with regulatory requirements. Note that a security risk assessment may also be called something slightly different, like an IT infrastructure risk assessment, a security audit or a security risk audit, or simply a more in-depth vulnerability assessment. Security risk analysis carries several benefits, including its ability to identify areas of weakness, maintain compliance, prevent damage to your operations and revenue, and help you stay up-to-date with security standards.

5 Steps to the Vendor Risk Management Process

Having a properly detailed process for managing vendor risk is crucial, especially if you’re trying to facilitate greater collaboration across teams in your organization. Vendor security risk management is an ongoing process and one you’ll execute with any future vendors you bring into your supply chain. Although the exact steps might vary between organizations, the general ideas are the same.

The typical process looks like this:

1) Analysis

First, vendor inventory is taken. This identifies every vendor and its relationship to your business. Only after this can your business conduct a vendor risk assessment, identifying the inherent risk of the vendor relationship and the level of due diligence to be performed. At this point, your business evaluates the third party’s security posture and performs a gap analysis.

2) Engagement

Your business and third-party should collaborate on how they can work towards remediating any security gaps. This may include implementing a security framework relevant to your industry. For example, healthcare organizations must comply with HIPAA; any vendor that deals with European clients must comply with GDPR. Design your third-party risk assessment so it addresses compliance requirements and regulatory requirements for the industry with the goal of strengthening the business relationship with potential vendors.

3) Remediation

The third-party must fix the cyber gaps. This may include establishing different security controls such as multi-factor authentication, limiting privileged access of data to only those who need it, and data encryption. It may also include sending security questionnaires to understand the vendor’s current compliance policies and procedures. In addition, your business should ensure that the vendor contract includes clauses related to data protection and compliance with your organization’s vendor risk management policies, as well as causes for vendor relationship termination and secure offboarding.

4) Approval

Your business approves the vendor relationship or rejects it based on risk tolerance, whether or not it has met compliance with industry regulations and how critical the service provider is for your organization’s business operations. Approved vendors must be documented, along with the reasons for the approval. (If vendors are rejected, this should also be documented, along with the reasons for the rejection).

5) Ongoing Monitoring

Organizations must continuously monitor the third party to detect any cyber gaps along the entire vendor management lifecycle. This is an essential and proactive approach to emerging threats. This includes the offboarding process to ensure that sensitive data shared with the vendor is no longer accessible to the vendor or deleted.

What is a Vendor Risk Management Plan?

A vendor risk management plan is similar to a vendor risk management program and vendor risk management process in that it identifies the scope and goals of your VRM in addition to identifying the vendors and the potential risk posed to your organization. However, it is different in that it also details the responsibility and role of both the vendor and your organization in the event of a security incident or data breach.

For example, in addition to detailing the role of your IT and third-party risk management team, your vendor risk management plan might also stipulate the responsibility of the HR team and executive leadership after such an incident.

What are Third-Party Vendor Risk Exchanges and How Can They Help Me with Vendor Risk Assessments?

Third-party vendor risk exchanges are a centralized point where organizations and third parties share and access information related to risk in real time. Organizations and their third-party risk management teams use it to access third-party risk data and respond to completed assessments from their third parties. Third parties use the vendor risk exchange to share their risk data and demonstrate their compliance with security measures with responses to security audits and questionnaires.

These exchanges offer many benefits for both parties:

- Organizations and their TPRM teams. Organizations benefit by gaining access to real-time data, reducing time spent on manual data collection, and the ability to better analyze risk data to identify trends and develop proactive measures to defend against risk. It is particularly useful for organizations looking to scale their TPRM and vendors who might be difficult to access, as they only need to apply once to use the exchange.

- Third parties. Third parties also benefit by demonstrating to customers that they are serious about risk management and reducing the need for multiple audits from customers. It also allows them to choose which parties have access to their risk data so that they can maintain control of their sensitive data while at the same time stay compliant with evolving regulations and build trust with customers.

What is a Vendor Risk Management Maturity Model (VRMMM)?

A vendor risk management maturity model (VRMMM) enables organizations to assess an organization’s third-party risk management programs and develop measures to improve it. In addition to being a tool for assessment and roadmap for improvement, it also allows for a holistic approach to the evaluation of vendor risk management so that all relevant areas of third-party risk are addressed. Since it is a standardized approach, it also enables organizations to measure their VRM against other organizations in their industry and understand exactly where they can improve it.

What are the Vendor Risk Management Maturity Levels?

Although vendor risk management maturity levels may differ slightly for each organization, most maturity assessments include five basic levels.

| Maturity Level | TPRM Status | Description |

| 1 | Ad hoc | Startups or organizations with limited resources for TPRM |

| 2 | Approved roadmap | Organizations that perform TPRM occasionally but not on a regular basis and do not have a plan in place |

| 3 | Established | Organizations with an established and approved TPRM program in place but are not yet fully operational and do not measure their performance |

| 4 | Operational | Organizations with a fully operational TPRM program in place and measure their performance |

| 5 | Continuous improvement | Organizations that are able to benchmark their success against others in the industry and make any relevant improvements necessary |

How to Create a Third-Party or Vendor Risk Management Checklist

When developing your vendor risk management process, it is essential to have a basic checklist of questions to ask internally and to your vendors. Please note that this list is only intended as a starting point, and should be customized based on your organization’s risk appetite, the level of risk posed, and according to your type of vendor relationship.

Questions should include:

- What are the current access controls used by the vendor?

- Is the vendor invested in data encryption, data security and information systems controls?

- Does the vendor have an incident response plan in place? Do they have a data recovery plan?

- Has your organization conducted a thorough examination of the vendor’s financial statements, including additional risks along the supply chain such as their subsidiaries’ risk history?

- What types of certification does the vendor have that is protecting data? For example, does it have ISO 27001 certification or SOC 2 certification?

- Has the vendor been in the news recently for bankruptcy, legal battles, or a sudden resignation of the CEO?

- Is the vendor willing to complete a vendor risk checklist or security questionnaire?

Vendor Risk Management Best Practices in 2024

In 2024, we see that best practices in vendor risk management have focused around three different trends: an increased use of artificial intelligence (AI), an emphasis on cloud-first strategies and increased regulations related to third-party risks.

1) Educating your third parties of AI risks

While an optimistic 61% of CISOs believe that AI could play a pivotal role in preventing more than 50% of third-party breaches, AI technology also poses risks. Risks include data privacy and control issues related to data leakage and biased data samples, misinformation and “hallucinations” result in inaccurate responses that hurt an organization’s reputation and damage user trust. Companies integrating these third-party applications should consider how their combined lack of resources and knowledge of mitigating risks make them attractive targets to attackers.

2) Staying up-to-date on regulation requirements

This is particularly relevant to regulations that focus on third-party risk, such as:

- DORA. The Digital Operational Resilience Act (DORA) was developed to regulate financial institutions in the EU to improve their cybersecurity resilience. This includes adopting Information and Communications Technology (ICT) security provisions such as mapping of third-party assets, evaluation of third-party criticality, and having a mitigation and remediation plan to deal with vulnerabilities as they occur.

- NYDFS. The New York Department of Financial Services (NFDFS) regulation is aimed at protecting the non-public sensitive information of financial institutions that conduct business with New Yorkers. It specifies guidelines for ensuring that data shared with third parties remains secure, including periodic risk assessments, the use of multi-factor authentication (MFA), encryption, and notification of any cyber incidents or data leaks.

- NIS2 Directive. This EU regulation includes a broader scope of organizations and industries than DORA. It outlines the types of security incidents that should be reported, including unauthorized access to services, data breaches and DDoS attacks. It also emphasizes the importance of proactive risk management, including third party and digital supply chain risk assessments.

3) Awareness of the increased emphasis on cloud-first strategies

As companies rush to increase the digital transformation of their businesses and their attack surface increases, they lose the control they used to have when these applications were on-premise. This is particularly true with regard to their data security. Many cloud infrastructure systems, such as AWS, operate on a shared responsibility model. Amazon takes responsibility for the physical security of their infrastructure, but the responsibility for software updates, configurations and data security remains in the hands of the SaaS providers hosting on AWS. When a company outsources a service to a SaaS payment service, for example, and that payment service uses a cloud provider such as AWS to host your company’s data, the company can’t make any assumptions about the security practices the SaaS service has in place to protect itself against data breaches or other types of attacks.

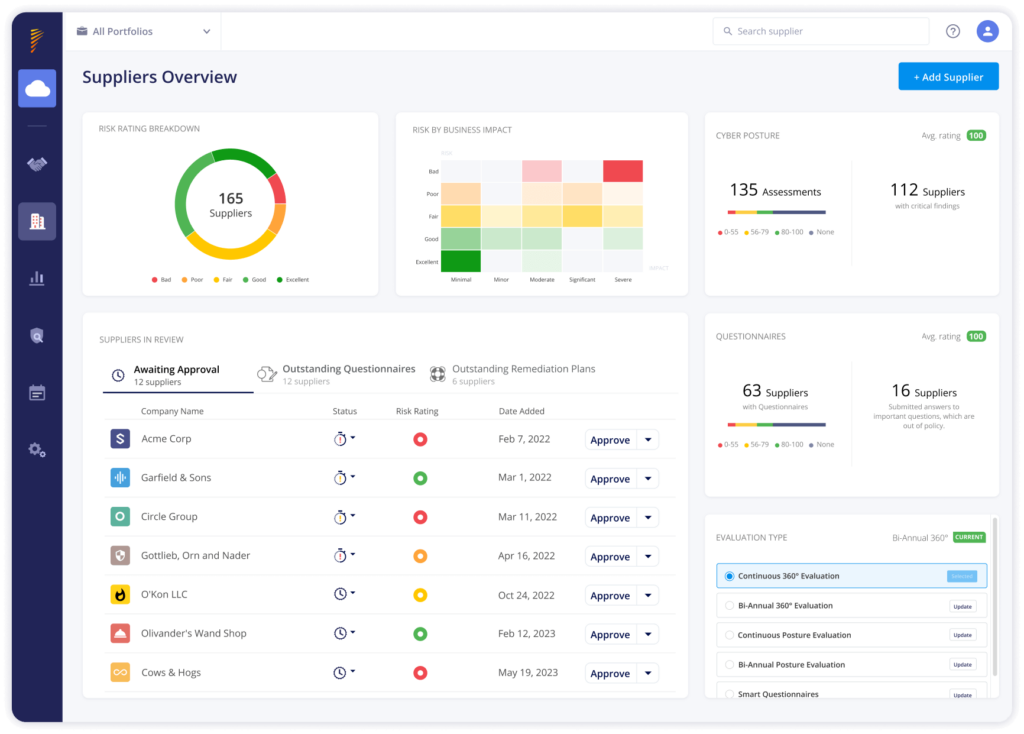

How to Automate Vendor Risk Management with Panorays

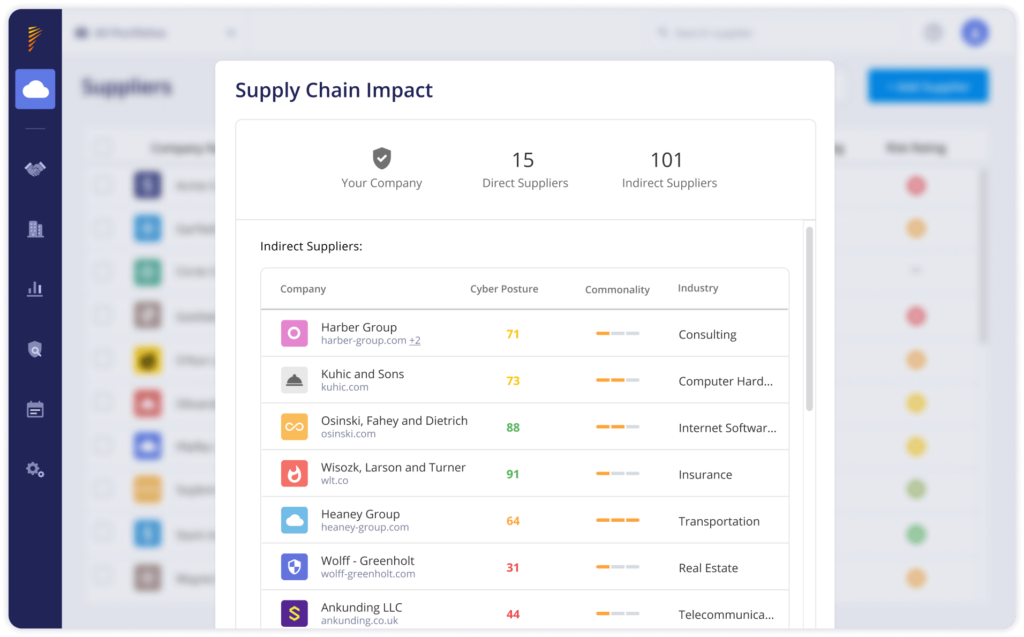

Panorays delivers a contextual business approach to vendor risk management that streamlines and automatically detects your threat landscape, including third, fourth and fifth parties and the risks posed to your organization according to their criticality. It then customizes its assessment and scoring based on criticality, sending alerts based on the risk level. Finally, it prioritizes the most important issues your third parties should remediate, delivering a step-by-step plan to close the gaps that pose the most risk to your organization.

Want to learn more about how Panorays can automate your vendor risk management? Get a demo today!